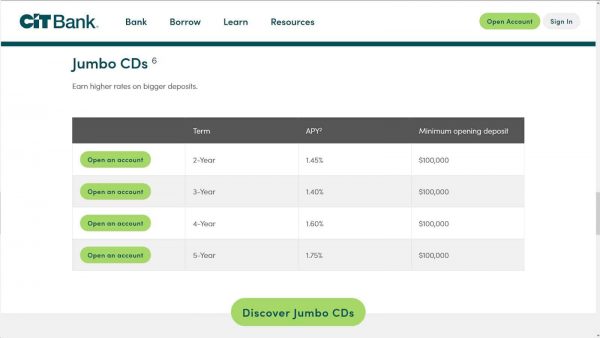

Some jumbo CDs may have five-figure minimum deposit requirements. Minimum deposit: While some of the best CDs have no minimum deposit, others may require a few hundred to a few thousand dollars.You'll usually find the longer the CD term, the higher the interest rate. Most range from six months to five years. It can range from one month on the short end to six years or more on the long end. CD term: The CD's term is the length of time you agree to not touch your money.APY: The APY tells you how much you'll earn in interest.Pay attention to the following factors when comparing the best CDs to find the one that's right for you:

CD RATES JUMBO 2 YEAR FULL

So make sure you're comfortable leaving your money in the CD for the full term before committing to one. But if you haven't yet earned enough interest to cover the penalty, your bank may take some of your principal as well. Usually, this just costs you some of the interest you've earned. The only time you can lose money is if you withdraw your funds before the CD term is up. These accounts are backed by the FDIC insurance for up to $250,000 per person per bank, so your money is safe even if your bank goes under. Are CDs safe?ĬDs are safe in the sense that you cannot lose money if you follow the rules. The earlier you withdraw the funds, the larger your penalty will be. Withdrawing your funds before the CD term ends results in a penalty - usually several months' worth of interest. Your bank pays that interest monthly or quarterly, and when the CD term is up, you may withdraw the funds and spend them, place them in a savings account, or put them in another high-interest CD. You deposit a certain amount of money into a high-yield CD and agree not to touch it for the length of the CD term in exchange for a high rate of interest that's usually locked in for the full term. If you withdraw the funds early, you pay a penalty, though some banks allow CD loans.

CD interest rates are often higher than what you find with most savings accounts, but they carry the stipulation that you must not touch the money until the CD term is over. What is a CD?Ī certificate of deposit (CD) is a type of FDIC-insured deposit account offered by many banks and credit unions that usually has a fixed interest rate over a certain number of months or years. Here are a few things you should know if you want to find the best certificate of deposit for you.

0 kommentar(er)

0 kommentar(er)